October 14, 2016

Stanton A. Glantz, PhD

$2/pack increase in CA tobacco excise tax will reduce smoking, save billions in healthcare costs, and create jobs

My colleagues at UCSF recently released two research studies on the effects of the proposed tobacco tax increase in California at Proposition 56. Links to the full reports are at the end of this fact sheet (which, itself, is available at www.escholarship.org/uc/item/9w38h5rn). Another summary of this work, as well as related work done at UCSD, is available at is http://www.trdrp.org/news/tax-policy-updates.html.

A $2.00 per pack increase in the tobacco excise tax will reduce smoking,

save billions in healthcare expenditures, and create thousands of California jobs

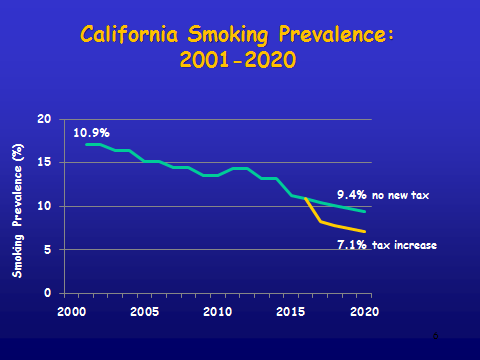

Smoking prevalence in California will be more than 2 percentage points lower in 2020 with the tobacco tax increase

- In 2020 just 7.1% of California adults will smoke, and the remaining smokers will smoke less

- Smoking rates drop quickly because of the combined effect of higher prices and a larger reinvigorated tobacco control program

- Fewer smokers will mean fewer smoking-caused deaths and fewer nonsmokers breathing secondhand smoke

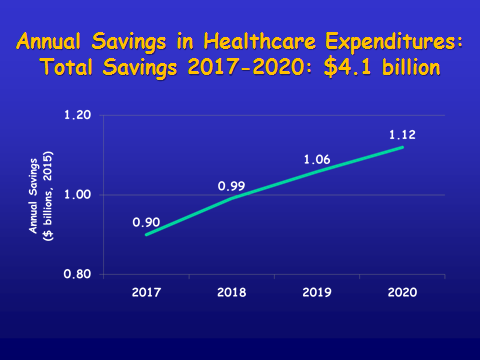

The tobacco tax increase will save billions of dollars in healthcare expenditures because fewer people will get sick

- Annual savings in healthcare expenditures will be $900 million in 2017, increasing to $1.12 billion in 2020

- Cumulative savings will total $4.1 billion between 2017 and 2020

- Hospitalization costs will be $2 billion lower

- Outpatient costs will be $1 billion lower

- Medication costs will be $650 million lower

70 million fewer packs of cigarettes will be smoked

- The tobacco industry will lose $250 million in sales every year

- Because no tobacco is grown and no cigarettes are manufactured in California, most of the money spent on cigarettes leaves the state and goes to Phillip Morris, RJ Reynolds, and their suppliers

- When people smoke less, they will spend the money they save on goods that contribute to the California economy, creating 8,600 new jobs and increasing California economic activity by nearly $700 million a year

Sources: (1) Max W, Sung HY, Lightwood J. The Effect of a $2.00 per Pack Increase in the Tobacco Excise Tax on Smoking and Healthcare Expenditures: 2017-2020. Available at: www.escholarship.org/uc/item/4g6677fq. (2) Lightwood J, Glantz S. Economic Impact of the California Healthcare, Research and Prevention Tobacco Tax Act of 2016. Job Creation and Economic Activity. 2012. Available at: www.escholarship.org/uc/item/9g738223. (3) Max W, Sung HY, Lightwood J. The impact of changes in tobacco control funding on healthcare expenditures in California, 2012–2016. Tobacco Control 2013;22:e10-e15. (4) Lightwood J, Glantz S. The Effect of the California Tobacco Control Program on Smoking Prevalence, Cigarette Consumption, and Healthcare Costs: 1989–2008. PLoS One 2013;8(2):e47145.

Research funded by the California Tobacco-Related Disease Research Program, grants #24ST-0051 and 24ST-0052.

Available at: www.escholarship.org/uc/item/9w38h5rn

Release date: October 11, 2016. Email contact: [email protected]

Comments

Saving money

Reducing cigarette consumption is a perfectly reasonable cause. But it doesn't save anyone any money.

People don't get sick much until they get old, and smokers don't get sick any more than non-smokers -- until it kills them. Not smoking will increase the lifespan of many, so will increase health costs, albeit postponed. Japan has the healthiest people in the modern world but they don't have the smallest health care budget, despite a very efficient system, because that health comes with the longest life-expectancy too.

Moreover there are other costs, like pensions, that will increase if people live longer. They have to counted in as well, if we are to do a fair accounting.

I'm all for cutting down smoking via tax increases (though not bans) but let's not kid ourselves it will save us money. It will cost in the long run.

Not so

While it is true that smokers die younger, they are sick for longer than nonsmokers and run up higher medical costs before they die.

The Congressional Budget Office did the most thorough and sophisticated analysis of this question to date and found that, even accounting for increased life span, tobacco taxes reduce government expenses. You can learn more about the studyhttp://tobacco.ucsf.edu/cbo-cigarette-tax-indexed-inflation-would-reduce... here.

Add new comment