October 17, 2016

Stanton Glantz, Professor of Medicine and Director of the UC San Francisco Center for Tobacco Control Research and Education is seeking a postdoctoral fellow to conduct policy research in the evolving policy environment around marijuana policy and how it interacts with tobacco control policymaking. This work will include research on the state and local policymaking process as it relates to tobacco control. The project involves preparing detailed case studies on policy making in states with a variety of marijuana policies, including research on the development and passage (or defeat) of relevant legislation, implementation, funding and management of marijuana and tobacco control programs, efforts of public health advocates to promote public health programs, and opposition to public health policies by the marijuana and tobacco industries and their allies and surrogates. Data collection will involve researching written records, relevant laws, analyzing campaign contribution information, conducting interviews and doing field research.

October 14, 2016

My colleagues at UCSF recently released two research studies on the effects of the proposed tobacco tax increase in California at Proposition 56. Links to the full reports are at the end of this fact sheet (which, itself, is available at www.escholarship.org/uc/item/9w38h5rn). Another summary of this work, as well as related work done at UCSD, is available at is http://www.trdrp.org/news/tax-policy-updates.html.

A $2.00 per pack increase in the tobacco excise tax will reduce smoking,

save billions in healthcare expenditures, and create thousands of California jobs

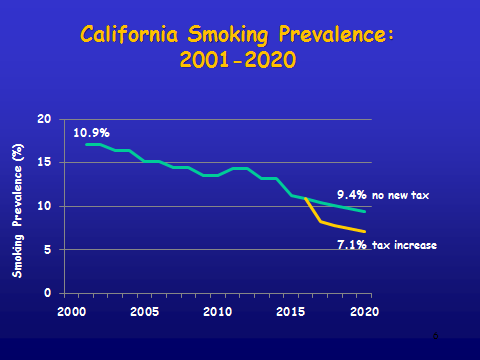

Smoking prevalence in California will be more than 2 percentage points lower in 2020 with the tobacco tax increase

October 9, 2016

An ad summing up the five Smoke Free Movies policy goals – (1) R rating films with smoking (with two limited exceptions), (2) Certification of no payoffs for smoking, (3) Require anti-smoking ads, (4) Stop identifying brands, and (5) End subsidies for movies with smoking – is running in Variety and Hollywood Reporter tomorrow, October 11, 2016.

This ad, together with earlier ads on the history of Hollywood’s deals with Big Tobacco and how we know onscreen smoking causes kids to smoke, provides a concise summary of the whole campaign that advocates can use in their educational efforts.

(We are using these ads to prepare a range of fact sheets and graphic elements for everyone to use in their efforts, which will be available by the end of the month.

October 6, 2016

A federal court’s August 2016 ruling opened the door to FDA approving Teddy Bear cigarettes. Here’s some background to explain why: The Family Smoking Prevention and Tobacco Control Act requires tobacco companies to obtain FDA approval before marketing new tobacco products. This can be obtained by submitting a comprehensive new tobacco product premarket application, or by convincing the FDA that the new product is “substantially equivalent” to one already on the market.[1] In September 2015 the FDA issued a guidance document saying that a change to a product’s label that makes it “distinct” from the labeling of the existing product creates a “new tobacco product” requiring FDA review before the product can be marketed.

October 2, 2016

http://elections.kqed.org/article/2010101856865/is-marijuana-safe-enough...

Broadcase September 28, 2016